Trump vs. Powell: The War for the Federal Reserve Escalates

The long-simmering tension between US President Donald Trump and Federal Reserve Chairman Jerome Powell has erupted into a full-blown constitutional crisis. What began as a series of vitriolic tweets and campaign trail insults has mutated into a direct executive assault on the central bank’s independence, culminating in a threatened Justice Department indictment, a defiance video from the Fed Chair and an unprecedented intervention by global central bankers.

The escalation: “gross incompetence” and indictment threats

The conflict reached a boiling point when reports surfaced that the Trump-aligned Justice Department was preparing to seek an indictment against Powell. The alleged charges do not stem from monetary policy errors, but rather accusations of perjury and “gross incompetence” related to the renovation costs of the Federal Reserve’s Eccles Building in Washington, DC

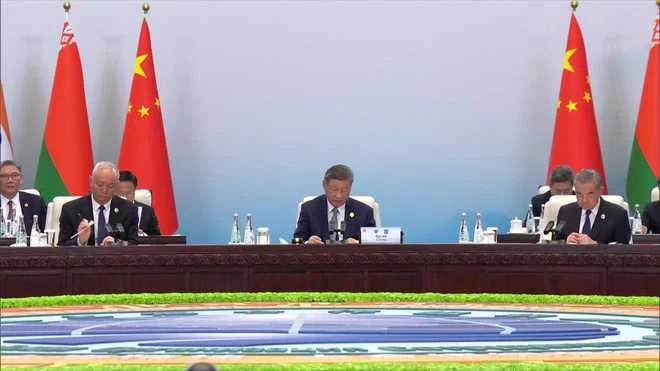

This legal maneuver follows months of escalating rhetoric. Since taking office in January 2025, President Trump has reportedly disparaged Powell in private and public forums, calling him a “moron,” a “jerk” and a “stupid person” on at least a dozen occasions. The animosity was on full display during a bizarre incident in July 2025, when Trump insisted on visiting the construction site of the Fed’s headquarters. During the tour, witnesses described the President jostling with Powell over cost overruns, using the backdrop of the construction zone to berate the Chairman in front of the press corps.

The Chairman of the Federal Reserve, of course, has very little involvement with the construction project.

Despite having nominated Powell for the position during his first term, Trump has called for his resignation multiple times in the last year, frustrated by the Fed’s refusal to slash interest rates to zero. The threatened lawsuit — ostensibly about building management — is widely viewed by legal experts as a spurious pretext to remove a barrier to the President’s economic agenda.

Powell’s “video response” and the European shield

In a move that surprised Washington, Powell broke with the Fed’s century-old tradition of stoic silence. On Sunday, January 11, the Fed released a video statement featuring a steely Powell looking directly into the camera. Without naming the President, Powell reaffirmed his commitment to the “rule of law” and the Fed’s mandate, declaring that he would not be intimidated by political pressure. The video, stripped of the usual central bank jargon, was a clear signal: Powell was not resigning.

The international community has rushed to Powell’s defense. On January 13, a coalition of 10 major central banks — including the European Central Bank (ECB) and the Bank of England — released a joint letter expressing “full solidarity” with Powell. The letter, a diplomatic bombshell, underscored that “the independence of central banks is a cornerstone of price, financial, and economic stability.”

However, the expression of support was not well received at home. Stephen Miran, a Trump-appointed Fed Governor who has become a vocal internal critic of the Powell consensus, dismissed the letter immediately. Miran called the foreign intervention “not appropriate,” arguing that global bankers have no business opining on US domestic legal matters.

The media reaction

Prominent voices in the financial world have begun to sound the alarm. Michael Bloomberg, the former mayor of New York City, published a stinging opinion piece titled “Let Powell and the Fed Do Their Jobs,” arguing that the politicization of the dollar would have catastrophic long-term consequences for US borrowing costs.

Market veterans like Mohamed El-Erian and Rob Arnott have also weighed in, though often with a focus on the broader implications of “fiscal dominance.” While El-Erian has frequently warned that the Fed is losing control of the narrative, recent discussions in the bond market suggest a growing fear that the Fed’s independence is being eroded not just by tweets, but by structural changes.

Senator Cramer, a member of the Senate Banking Committee, suggested that it “would be an elegant solution for the Fed chair to step down in exchange for dodging a political indictment”. Which carries the same vibes as offering to purchase someone’s corner store for a dollar “to avoid losing it to flames one day”.

“Well I’d love that, I mean, we all talked about getting him [Powell] out of there [Federal Reserve] quipped Larry Kudlow on FOX News.

The attempt to fire fellow board member Lisa Cook — a case currently winding its way through the Supreme Court — further illustrates the administration’s “cleanup” strategy to install loyalists at the Board of Governors.

The Data: A “supercharged” economy complicates the narrative

The irony of the President’s demand for rate cuts is that the US economy, by many metrics, is running too hot, not too cold.

According to the Atlanta Fed’s “GDPNow” model, the estimate for real GDP growth in quarter four (Q4) 2025 stands at a staggering 5.4% as of January 21, 2026. This “supercharged” growth rate defies the narrative of a recessionary economy in need of monetary stimulus.

Furthermore, inflation remains sticky. Core personal consumption expenditures (PCE) inflation — the Fed’s preferred gauge — is currently tracking around 2.7% to 2.8% year-over-year, above the 2% target. With unemployment at a relatively healthy 4.4% (as of December 2025), the data suggests the Fed should be cautious, not aggressive, in cutting rates.

The Taylor Rule calculation

To understand just how divergent the President’s demands are from standard economic theory, we can use the Taylor Rule, a standard formula used by the Atlanta Fed and economists worldwide to estimate the “appropriate” federal funds rate.

In simple terms, the Taylor Rule is a formula for finding the “perfect” interest rate. If prices rise too fast (high inflation), the Fed needs to cool things down by raising interest rates. If people are losing jobs and businesses are closing (recession), the Fed needs to warm things up by lowering interest rates.

The rule starts with a “Neutral Rate.” This is the interest rate where the economy is cruising comfortably — neither speeding up nor slowing down. The neutral rate is assumed to be 2%.

The Taylor Rule then looks at two gauges and tells the Fed to adjust the rate up or down: inflation and growth.

For every percentage point inflation exceeds the target (currently 2%), the neutral rate is increased by the difference, multiplied by 1.5. With inflation at 2.7%, we should add 1.05 (0.7 x 1.5) to the neutral rate.

Next, the Taylor Rule considers GDP growth and the job market to determine if there is an “output gap” (when economic output is below potential), in which case points are deducted from the neutral rate.

However, with the latest estimate for Q4 2025 real GDP growth (5.4%), the US economy seems to be running “hot” and above potential. This would require a surcharge on the neutral rate.

Given strong economic growth (around 8% nominal), the Taylor Rule prescribes a rate significantly higher — potentially over 5% — to prevent overheating. By this metric, Powell is already being incredibly dovish.

Governor Miran, however, argues that the neutral rate has fallen due to specific fiscal and migration factors. He has stated that the Fed Funds rate should be slashed immediately by 100–150 basis points (1–1.5 percentage points). Miran’s interpretation provides the academic cover for Trump’s political demands, suggesting that the “true” rule points to much cheaper money.

In December 2025, Miran claimed that official inflation was overstated, implying that monetary policy should be more accommodative (i.e., lower interest rates). He cited asset management fees contributing 30 basis points (0.3 percentage points) to core inflation. Have you ever heard your Uber driver complain about rising asset management fees?

Did you know that US health insurance premiums are apparently falling? That’s what recent government data suggests. This occurs because the Bureau of Labor Statistics (BLS) uses an “indirect method” to calculate the health insurance component of the Consumer Price Index; it deducts benefits (payouts) from insurers’ retained earnings (profits). If your insurance raised your premium by 5%, but increased payouts by 10% (due to a bad flu season, for example), the insurance company’s profits shrink, which BLS will report as a price drop (even as you pay higher insurance premiums). Have you ever heard a person say, “My insurance reduced my premium?”

Implications: the dollar in the crosshairs

The assault on Powell and the attempts to purge members like Cook signal a shift toward a “pliant” Federal Reserve. If the central bank loses its credibility to fight inflation, the premium investors demand to hold US Treasury bonds could soar.

A long time ago, we used gold coins as a means of exchange. Those were replaced by receipts for gold coins, for safety and convenience. Then, the gold coins were removed, but we continued to exchange receipts, despite the fact that they had no tangible backing. Later, we moved to an electronic representation of those receipts. Today, stablecoins offer another layer of abstraction.

Central banks’ formidable task is to prevent a loss in a trust-based system. Undermining central bank independence is the best way to destroy this fragile construct we call “money”. Once trust is destroyed, it is very hard to earn back, usually only by offering additional assurances, like a gold backing.

The markets are reading the signs, bidding up the prices of gold, silver and many other commodities. There are no “lines at the gold shop” yet, but we are on the best route towards a disruptive outcome of irresponsible monetary and fiscal policies.

[Kaitlyn Diana edited this piece.]

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

The post Trump vs. Powell: The War for the Federal Reserve Escalates appeared first on Fair Observer.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0